INVESTMENT COMMENTARY

|

APRIL 2025

TARIFFS, TRADE AND TREACHERY

The last week’s equity market retracements have been widely reported on by global media outlets. After a volatile March during which the Trump administration finalised their Executive Orders and started the implementation process, the start to April has been quite extraordinary. We mentioned the dearth of decency and diplomacy in our mid-March note. To continue with our alliterative approach, what has happened in the first few days of April has been more akin to deranged and destructive.

It has been difficult to make sense of the current tactics. The numbers on which the tariffs were based were calculated using current trade deficits rather than existing tariffs on US exports. This is clearly anomalous. Some of the biggest losers from Wednesday’s Rose Garden circus were Cambodia, Laos and Myanmar with 49%, 48% and 44% tariffs respectively. The callousness of thumping (in particular) Myanmar – which has just suffered a huge earthquake and an ensuing humanitarian disaster – is indicative of the administration’s desire to exhibit its merciless endeavour to redress old inequalities. When one sees the aforementioned south Asian countries near the top of the list, and the methodology, which has clearly been misapplied to make the calculation, it really is unbelievable this is the US administration at work.

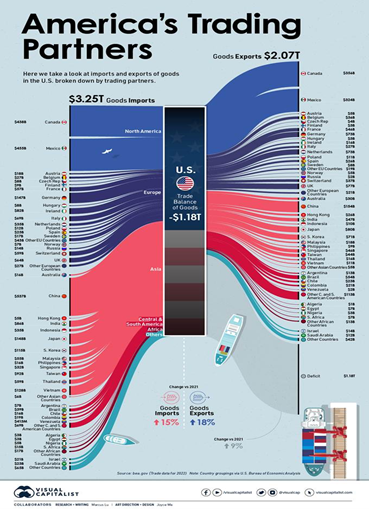

Source: Visual Capitalist

Other big losers have been the Falklands (which exports fish to the US) and Norfolk Island, which has a population of 2,188 people and no trading relationship with the US. Two miniscule island territories with no tariffs on US exports.

One could be forgiven for thinking the lunatics genuinely have taken over the asylum.

What is more difficult to fathom is that some of the individuals who stood cheek by jowl at the Trump inauguration have been the biggest losers financially in the last week. While it is true to say they have the capacity to lose a few hundred billion between them, they cannot have believed this would have been how the first three months would have played out when they U-turned on DEI policies, stopped their media outlets writing anything which was critical of MAGA and publicly endorsed Trump for President.

So far in April, our calculations show the market capitalisation of companies managed by the individuals flanking Trump at his inauguration have fallen by the following amounts:

Tim Cook, Apple 15.2% or $430 billion

Mark Zuckerberg, Meta / Facebook 10.2% or $140 billion

Elon Musk, Tesla 10.8% or $81 billion*

Sundar Pichai, Google / Alphabet 5.6% or $100 billion

Jeff Bezos, Amazon 9.3% or $168 billion

Share prices taken from www.google.co.uk

* We highlighted the share price falls in Tesla in March’s note.

It is difficult not to feel some sense of serendipity when seeing these numbers.

Some of the rhetoric from the Trump administration has focused on ‘getting rich when the market rebounds’, but for this to happen there will need to be an almost immediate reigning in or cancellation of the spurious tariffs. As has been covered earlier in this article, this administration is not one which will be remembered for being conciliatory. Rather the complete antithesis.

BUT WHAT IF….?

So far, we have been negative on the implementation of wholesale, unilateral tariffs. However, the other side of the argument is that there is an outside chance this is an act of defiance to the US central bank, the Federal Reserve, which has been carefully conceived by the Trump administration to force the cost of borrowing down. It is certainly radical andhighly risky, but Trump has always maintained that reducing the fiscal deficit is his overriding objective, by it seems, whatever means.

In our January communication, we remarked that the US debt is currently $36.5 trillion. $9 trillion of this has to be refinanced throughout 2025 with a further $19 trillion before the end of 2028 (Axel Funhoff, Elysion Capital and Professor, Antwerp Business School).

When Trump was inaugurated, the US 10-year Treasury had a yield of c.4.5%. Due to the equity market retracement since early-March, and particularly during the last week, the yield on the 10-year Treasury is now below 4% as investors have shifted to a more ‘risk-off’ approach. The rhetoric from the Fed chairman, Jerome Powell, is one of nervousness and concern for the US economy – and this should echo too around the rest of the world. He knows panic in markets may force his hand into cutting rates, something he has hitherto been reluctant to do because of existing inflation concerns and, moreover, the inflationary impact of tariffs on prices.

Source: Bloomberg

Trump’s contention is the deficit will balloon by many trillions more dollars if, over the next four years, the US is not able to drive down the cost of borrowing. Their favoured mechanism to establish this process appears to be to create some kind of major shock or recession which would also create pandemonium for the rest of the world. The (intended) result: to elevate itself again to undisputed king of the world, reinstating its absolute hegemony.

It should not be ignored that if this pain can be inflicted in the early part of Trump’s term, then in the latter part he can take credit for one of the most radical pieces of fiscal manipulation, which he claimed will have ‘saved America’, it may well be that he makes an audacious bid for a third Presidency. Nothing would surprise us any longer.

YOUR PORTFOLIOS

For some considerable time, certainly for the last three years, we have had exposure to the US equity market through several different vehicles. Some are actively managed, which means we select managers who we feel will work well in the prevailing environment. Some are passive, which means we are exposed to the broader market. One more innovative method by which we have had exposure to the US equity market is through an equally-weighted vehicle. This means the smallest companies in the S&P have the same impact on the level of the index as the largest companies; Apple, Microsoft, Amazon etc.

While the share price falls above look dramatic (and they are), our active and more innovative approach will shelter you to a significant extent from some of the huge falls you will have seen, specifically in the tech sector.

We may look to make investments over the next few days or weeks if we feel the selling is overdone to take advantage of any weakness in an ongoing endeavour to maximise your returns and provide a better risk adjusted return.