INVESTMENT COMMENTARY

|

JANUARY 2026

INTRODUCTION

After an unpredictable 2025, it always seemed likely 2026 would follow in a similar vein. And the first two weeks of 2026 have not indicated anything other than a ratcheting up of the current extraordinary geopolitical tension, most of it coming from the White House. The arrest of the Maduros in Venezuela, open discussion regarding the annexation of Greenland, and military manoeuvres by the United States, particularly in the Middle East, all imply the Trump administration will use 2026 as its year to force the MAGA mantra prior to November’s midterm elections – with little or no consideration for the potential collateral damage.

After data became available, following the US government shutdown, the US printed GDP growth of 4.3% in Q3 2025, which was remarkable when one considers the UK’s plight of stagnant or narrowly negative growth over the same period and throughout 2025 as a whole. However, US data is weakening and its economic metrics look to be deteriorating, albeit gradually. The US tariffs could be starting to bite.

Despite these somewhat concerning economic factors, usually fundamental to corporate success and investor sentiment, US, UK, European, Japanese and many other developing markets are trading at, or close to, their all-time highs. We wrote to you in October 2025 highlighting the phenomenon of a ‘melt-up’; a momentum-based, sharp rise in asset prices, often at odds with the prevailing economic and geopolitical backdrop. We appear still to be in the midst of this melt-up. Our nervousness is two-fold: melt-ups can prevail for far longer than is rational, and they can often act as a precursor to a retracement in asset prices which is as sharp and pronounced as the melt-up, i.e. the ‘melt-down’.

REVIEW OF 2025

After some real blockbuster years for US equities, and particularly the ‘Magnificent Seven’ US technology stocks, other less-expensive markets were favoured by investors last year. In 2025, the FTSE 100 rose by 25.8%, the Euro Stoxx by 28.0%, Emerging Markets by 24.4%, and the Japanese Nikkei by 17.8%. Even the FTSE 250, more of a barometer for UK plc than the global FTSE 100, generated a return of 13%. All more than the US S&P 500 at 9.8% (all figures are total return and in sterling. Source: FE Analytics, January 2026).

The post-‘Liberation Day’ (tariff implementation day) fall across global equity markets in early-April 2025 reminded investors of the inherent risks of investing in shares and the potential volatility they can exhibit. However, the dip was also a reminder of the opportunities equity markets can present, and the 42WM investment team took a position in a global equity tracker – as passive investment vehicle – at the nadir of the sell-off. We continue to hold that investment which has grown by 25% since our purchase.

Throughout the second half of 2025, the investment team took the decision to begin a gradual de-risking of your portfolios by decreasing exposure to equity risk, primarily in the US where valuations had reached levels that seem to be unsustainable given analysts’ forecasts and the economic data – see our earlier comments regarding the ‘melt up’. Previous similar scenarios have shown that melt-ups are often accompanied by a corresponding increase in volatility. And our experience of working on behalf of private clients tells us to restrict unnecessary volatility wherever and whenever possible.

By remaining more fully invested in the UK, Europe, Japan and Emerging Markets, we were able to continue to perform robustly throughout a period during which we were reducing exposure to global stock markets and risk – our research led us to the conclusion that it was the historically less favoured markets which were due a period of stronger performance.

We have written before about our experience, conviction and nimbleness in challenging markets and this, we hope, should reassure our clients that our compact team is an optimally performing one – we have all of the expertise, experience and resilience of a larger company, but without the bureaucracy and other cumbersome elements which slow decision-making and impede flair and innovation.

Having looked at a large sample of client portfolios over the last week, an exercise we carry out regularly to measure and ensure portfolio alignment, we have observed that in November and December of 2025 the company we use to provide peer comparison benchmarking for our portfolios (Asset Risk Consultants) showed flat, i.e. no growth, or negative returns amongst an average of our peer group. Our choice of investments in the equity allocation and other asset classes (fixed income and alternatives: gold, property, infrastructure and absolute return funds), as well as our decision to reduce exposure to US equities as they became more volatile, and invest instead in steady, income producing cash proxies, has enabled us to generate growth in our portfolios as our peer group’s portfolios stagnate or retreat.

SUMMARY

We wanted to write a brief note about 2025 without revisiting the granular detail of what transpired and why (there will be plenty to concentrate on in the year ahead). It is important to everyone at 42 Wealth Management that our clients feel well looked after as it is our mantra that you, our clients, come first.

2025 was not a straightforward year to navigate and, so far, 2026 exhibits all the hallmarks of being another (potentially) tricky year. Our decision to finish 2025 and start 2026 with a defensive tilt was unanimous in our December investment committee meeting. Geopolitics and sentiment is sometimes referred to as ‘noise’ by market commentators, and we try not to be overly influenced by extraneous factors. When the noise becomes deafening, however, taking precautions – particularly when there are some attractive, low-risk alternatives available, and after a strong preceding year’s returns – reassures us and, we hope, our clients.

We will continue to provide you with regular updates to explain our worldview, changes to asset allocation and any prognostications we are bold enough to make in this tumultuous environment.

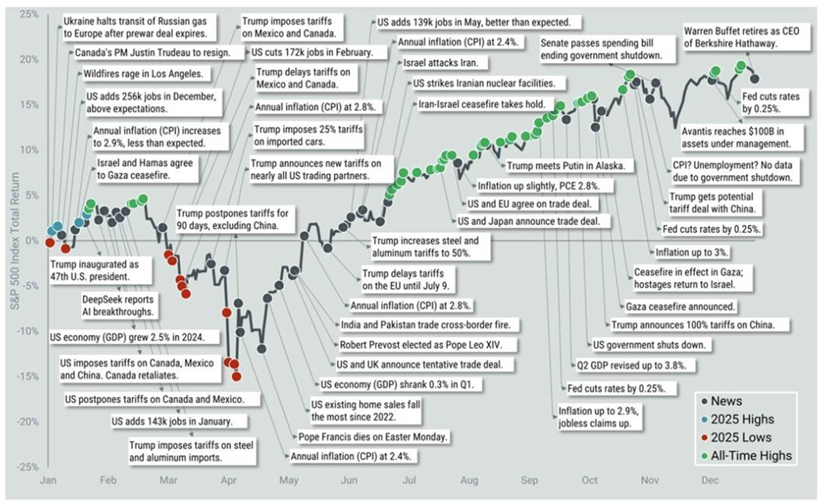

Finally, to provide an idea of those events which had a bearing on markets last year, we received this overview of 2025 in an email last week. It will be interesting to see how this year’s chart takes shape over the course of 2026.

Source:Avantis Investors (January 2026)

A very Happy New Year to you from all at 42 Wealth Management.