INVESTMENT COMMENTARY

|

MAY 2025

THE EYE OF THE STORM…?

Following the last couple of months’ notes, our May note has a more positive tenor. US tariff discussions have begun and appear significantly less disastrous than ‘Liberation Day’ suggested. The UK and US have agreed a trade deal, and markets appear more sanguine about the lay of the land. And, just yesterday, Trump pushed the 1st June deadline for negotiations forward to the original end of the 90-day negotiation period to 9th July. Mercifully, it appears someone in the Trump cabinet finally plucked up the courage to explain to the President the destructive force he was unleashing not just on the global economy, but more importantly for him, the US, where his approval rating for the first 100 days of his second term was lower than that of his first term. Together they represent bottom and second bottom of the approval ratings of any president since American independence in 1789.

In the early part of May, the S&P500 rose 13% in five trading sessions led again by the ‘Magnificent 7’ technology stocks, many of which had been responsible for the leading the US market to its nadir in early-April. The bounce back has not just been in the technology sector. Other more defensive sectors have rallied significantly too, exhibiting investors’ nervousness that we may just be in the eye of the tariff storm.

UK (FTSE 100), European (Eurostoxx) and Japanese (Topix) equity markets are all in touching distance of their February highs as sentiment has turned positive again. Indeed, these markets were less volatile during the recent turbulence as investors saw them as intrinsically less impacted by the threat of tariffs than the US and China. The UK has now agreed a trade deal with the US and ‘Brexit reset’ with the EU which may lead to a re-rating of the market as investors look to it as a source of more dependable returns. The Chinese (Shanghai Composite) and Indian (Sensex) markets remain some way off their recent highs as both are yet to agree a more permanent trade agreement with the US. India and Pakistan have also had a recent tit for tat exchange in Kashmir which unnerved investors. However, fears of an escalation appear to be waning and it may be that it is just another chapter in the thorny relations at the border.

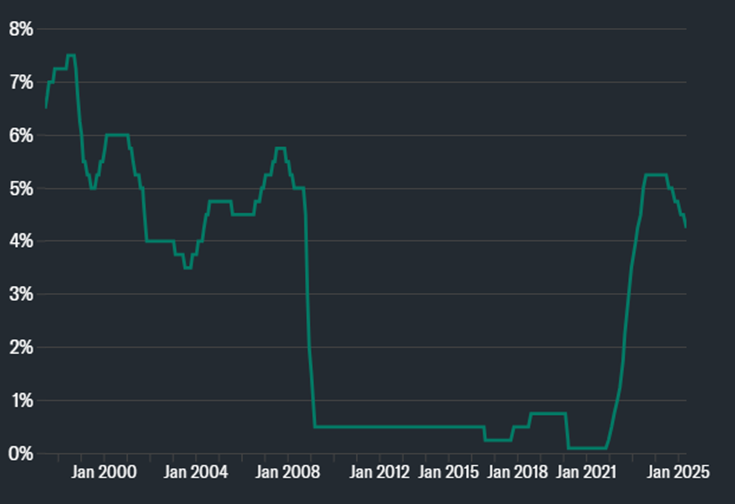

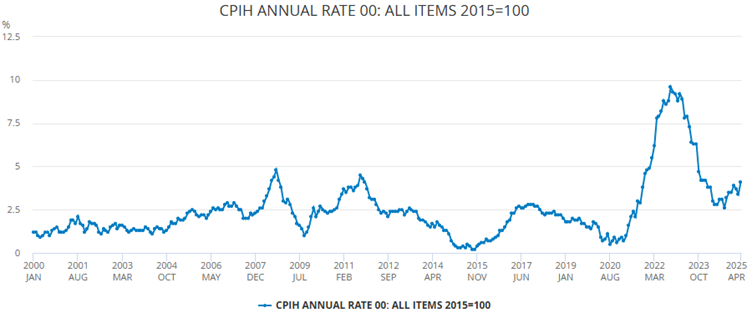

The Federal Reserve, the US central bank, continues to review economic data before committing to interest rate cuts in a further blow to the Trump administration which has a fractious relationship with the Fed. The UK’s Bank of England (BoE) has been more constructive, having cut interest rates twice already in 2025, most recently earlier this month to 4.25%. This has led the BoE’s chief economist, Huw Pill, who voted against this most recent cut, to express some concern about the pace of interest rate cuts in the UK. Given the most recent April CPI measure at 3.5% (annually) increased from 2.6% in March suggests he may be right. It is certainly likely to result in no further UK rate cuts for the time being, until inflation demonstrably renews its downward trajectory.

UK interest rates since 2000

Source: Bank of England

Consumer Price Index (CPI) since 2000

Source: Office for National Statistics (ONS)

The recovery in equity markets, improving sentiment, the emergence of trade deals and the likelihood of interest rates remaining higher for longer have all contributed to a recent retracement of the gold price from its recent highs of $3,500 per ounce following a seemingly inexorable rally – it is $3,300 today. Despite this, investors continue to increase their holdings through exchange traded funds (ETFs) as trade and geopolitical uncertainty continue to prey on their minds. Central bank buying, particularly in the developing world, remains consistent which is likely to keep the trend for the gold price positive. Goldman Sachs has a price target of $3,700 for year-end 2025 and JP Morgan predicts it moving above $4,000 in the second quarter of 2026.

We continue to hold our position as a hedge against any further geopolitical turbulence.

PORTFOLIO ACTIVITY

In our April note, we stated we intended to buy the dip, and we did. On 10th April, we bought a global equity tracker just off the lows of global stock market indices. Buying in such challenging conditions can confound investors, but these opportunities do not often present themselves, so we felt it an opportune time to increase your equity exposure. This position now sits on a handsome short-term profit.

The strong rebound in markets has led us to rethink our asset allocation and geographic split of equities in portfolios. Given the Trump presidency still has more than three years to run, and the impact the administration has already had on US equity and bond markets, we will be reducing our US equity exposure in favour of Japanese equities. We will also initiate a position in a pseudo-cash fund which generates an interest income of nearly 5% annually which will provide ballast and liquidity to take advantage should we experience any further volatility

We feel the Japanese market presents an excellent opportunity on valuation grounds with the headline Topix index trading on approximately 14x price to earnings. This compares to the US which trades on nearly double at 27x (from www.worldperation.com). In addition, Japan has recently undertaken some seismic changes in corporate governance – stopping companies from being overly insular in their approach to operations – while remaining one of world’s most stable economies. Analysis of Japanese equities shows it to be one of the most underinvested markets, which is starting to attract both international investors and, notably, domestic investors who are notoriously risk-averse and have hitherto favoured low-yielding Japanese J-Bonds – the equivalent of UK gilts.

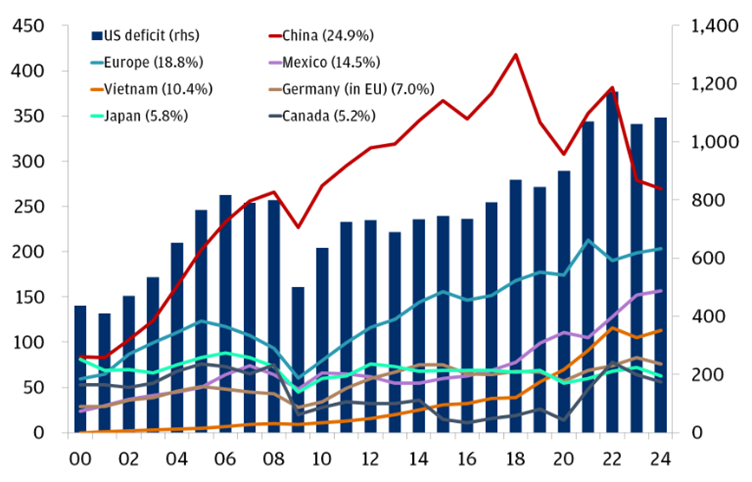

One final feather in Japan’s cap is its consistently low US trade deficit. This is likely to be a key tenet in the upcoming trade negotiations with the US. In a recent meeting, Trump raised Japan’s trade surplus with the US which was quickly rebuffed by Prime Minister Ishiba who asserted that Japan is, and remains, the largest source of foreign direct investment into the US. In the upcoming trade discussions, Trump is likely to push for more demand for US oil and liquid natural gas (LNG) and Japan will almost certainly appease the administration. Our expectation is that this bilateral trade agreement will be one of the less tumultuous and that the Japanese economy will be largely unscathed by the talks. For these reasons, we are happy to increase our exposure in Japanese equities.

US trade deficit and partner countries, USD billions

Source: JP Morgan Investment Bank

SUMMARY

As the above illustrates, the world is a fast-moving place with changes to geopolitics, economics and policy often changing intra-day. As discretionary managers, we remain committed to being nimble, well-diversified and active. We also have an excellent, diverse and highly experienced investment committee which has the courage to make brave decisions when apathy and inactivity may seem the path of least resistance.

We thank you for affording us the privilege of being the stewards of your investments throughout such an uncertain period.