INVESTMENT COMMENTARY

|

SUMMER 2025

In our last note to you we questioned whether, just over half-way through the Trump administration’s 90-day tariff negotiation period, we were in the eye of the tariff storm? Most risk assets would suggest not: the S&P 500 and NASDAQ (the US technology market), recorded all-time highs on Thursday last week. The FTSE 100 has printed its highest close since we last wrote to you while the Eurostoxx and Nikkei are all flirting with historic highs achieved either earlier this year or in late-2024. So, rather than the hiatus of April being reinstated and revisited, it seems risk markets have weathered the tariff storm remarkably strongly in the face of growing geopolitical tensions in the Middle East.

Equities continuing to remain so robust in the face of an increasingly fraught geopolitical backdrop is unusual. Indeed, throughout much of the last four decades, and particularly during the last sixteen years – since the great financial crisis (GFC) and in the wake of Covid-19 – risk markets benefitted from what was called the ‘Fed Put’; the Federal Reserve’s intervention to make conditions more benign for risk assets by providing liquidity and/or lowering interest rates (more ‘dovish’ monetary policy). The fractious relationship between Donald Trump and the Fed chairman, Jerome Powell, is not the sole reason for the ‘Fed Put’ being rejected as current policy. Their relationship may even be symptomatic of the Fed’s perceived inaction. But it is unusual for global sovereign bond yields to rise concurrently with equity values during such a tumultuous economic and geopolitical period. Only last Tuesday, July 1st, Powell explained he would already have cut rates in the US had Trump not threatened tariffs, to which Trump responded in his usual laconic manner by calling Powell ‘a moron’.

This Wednesday, 9th July, the 90-day tariff negotiation window will close – or it could be extended. Following the fallout from ‘Liberation Day’, it seems unlikely anything quite so aggressive will be announced. But it is notable that the US and China have not yet reached a bilateral agreement of any kind, save a narrow understanding in late-June on the export of ‘rare-earth’ minerals (Chinese concession) and the import of Chinese electronics (US concession).

The preliminary agreement with China on rare earths, reached on June 26th, has been lauded as a small step toward de-escalation. But it is narrowly focused on the critical minerals required for green technologies and military equipment. Broader issues remain unaddressed, and both sides have signalled scepticism about the likelihood of further comprehensive deals before the tariff deadline.

This truce covers only a fraction of the issues that have soured bilateral ties, with structural factors such as intellectual property, forced technology transfers, and the trade deficit seemingly unresolved. Analysts have warned that unless comprehensive negotiations resume soon, the global supply chain for high-tech industries could remain fractured.

Earlier this month, Vietnam agreed to a reciprocal tariff arrangement: a 20% US tariff on Vietnamese goods (down from the 46% originally threatened) in exchange for Vietnam dropping its tariffs on US exports. Crucially, the deal included strict measures to prevent Chinese goods from being relabelled through Vietnam to evade US duties – a growing concern as trade diversion threatens Trump’s aim to reduce the US-China trade imbalance.

Other key US trading partners – Japan, India, the EU, Canada, and Mexico – remain in protracted negotiations. Without new deals, these countries could see tariffs surge to 70% or higher after 1st August, threatening to further fragment global trade and deepen cost pressures on American consumers and businesses.

Unsurprisingly, commentators and high-profile investors are polarised in their prognostications of what happens next. What unites them is that few are expecting a smooth ride.

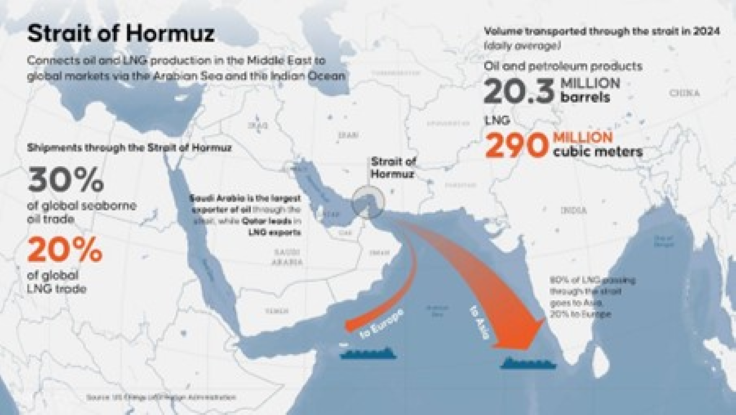

THE OIL PRICE: THE STRAIGHT OF HORMUZ

It has been a good while since the oil price seemed worthy of any significant mention, having trended slowly lower since the invasion of Ukraine by Russia. Instead, ‘Magnificent 7’ stocks, Bitcoin and AI have stolen its thunder in recent years. However, escalating tensions in the Middle East, particularly in the wake of the recent US involvement in the Israel vs. Iran conflict, has focussed our attention on the potential for an oil price spike. Oil price rises are nearly always inflationary as a higher price is seen as a tax on the global economy.

Since the US strike on alleged uranium enriching facilities in Iran, Iranian forces have been reported to be harassing international tankers and conducting drone attacks in order to disrupt regional production facilities. This has stoked fears of a supply shock and led to a modest spike in Brent crude prices, which rose to a $90 per-barrel intra-day high in mid-June before stabilising.

Source: Google

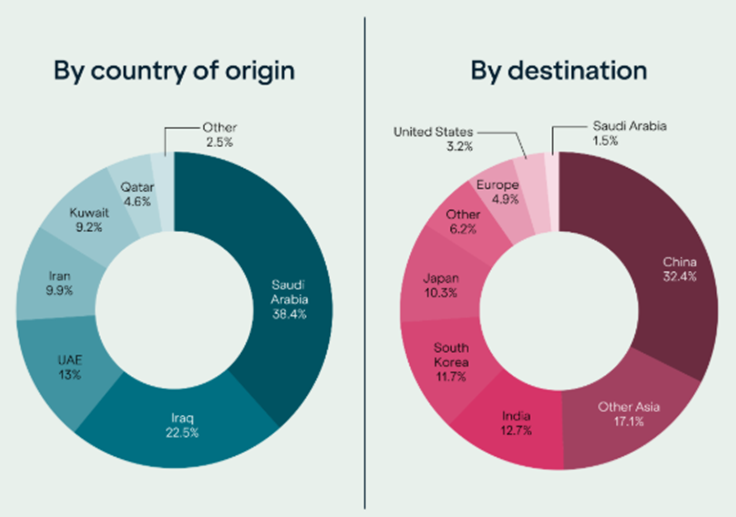

Approximately 20 million barrels of oil and liquified natural gas (LNG) pass through the Strait of Hormuz, a narrow corridor between Iran and Oman. This represents approximately 20% of the daily global consumption – and for context, is more significant (in terms of volume) than the Suez and Panama Canals combined. The Middle Eastern oil, originating in Saudi Arabia, Iraq, Kuwait, the UAE and Iran, is destined primarily for Asia, with over 80% bound for China, India, South Korea and Japan.

Source: US Energy Administration 2024

Following the US strikes of Iran’s nuclear facilities on 21st June, the Iranian Parliament has approved restricting the flow of tankers moving through the Strait of Hormuz or closing it altogether. It is now for the National Security Council to decide which, if any, to implement. Iran is the net beneficiary of the Strait of Hormuz remaining open, so the continued harassment of other nations’ tankers maybe a temporary and effective solution – Iran would be unlikely to do this itself, likely delegating it to Iranian backed militias such as the Houthis.

Despite the US being largely unaffected by the supply shortage in the Middle East – the US has a plentiful domestic supply – any miscalculation in the Gulf could send oil prices soaring, stoking inflation globally and forcing central banks to confront stagflation-like dynamics. This is something all capitalist economies should want to avert.

PORTFOLIO ACTIVITY

Periods such as this are when diversification within portfolios is paramount. Our exposure to UK and European stocks throughout the recent turbulence has provided a cushion against some of the volatile moves in the US tech giants. Holding those ‘old economy’ names, which include energy stocks, and are more exposed to the UK and European markets than the US, has allowed us to benefit from some of the energy price turmoil.

Our multi-asset focus, and geographically diversified equity exposure has enabled us to protect your portfolios significantly during the sharp sell-off in late-March and early April. And our nimbleness, active management and deployment of capital at the recent lows has provided portfolios with additional participation in the recovery, and has tracked valuations upwards during a period where markets have been volatile and made little headway.